Month: February 2023

Getting started in ANY business can be challenging. What do I do first? How can I use my time MOST effectively? Should I spend money? What about ROI? All good questions.

In today’s presentation, we’ll cover the following topics:

- Why do you need a website as a new REI?

- What helps a Real Estate Investor website be successful?

- What are the low-hanging fruits, the best next steps?

Enjoy!

If you have questions or comments, leave them in the comment section below.

Pre-WEB801 Webinar 2.7.23 by Nate Moller

In the ever-evolving world of real estate investing, staying ahead of the curve is paramount. While traditional marketing methods still hold value, the digital landscape presents a powerful opportunity to connect with motivated sellers and generate leads. But for real estate investors venturing into the world of digital marketing, the sheer volume of information and available platforms can be overwhelming.

This comprehensive guide empowers you, the real estate investor, to navigate the digital marketing landscape with confidence. We’ll explore key strategies, actionable tactics, and best practices to establish a robust digital presence and attract high-quality leads that fuel your investment success.

Why Embrace Digital Marketing for Real Estate Investing?

The traditional methods of networking and yard signs still have their place, but digital marketing offers several compelling advantages for real estate investors:

- Targeted Reach: Unlike traditional marketing methods that cast a wide net, digital marketing allows you to laser-focus your efforts on reaching the specific audience you’re looking for. Whether you specialize in flipping single-family homes, acquiring rental properties, or investing in commercial buildings, digital marketing allows you to target motivated sellers based on demographics, location, and property type.

- Cost-Effectiveness: Compared to traditional advertising methods, digital marketing offers a highly cost-effective way to reach your target audience. Platforms like social media and email marketing allow you to connect with a large pool of potential sellers without breaking the bank.

- Measurable Results: The beauty of digital marketing lies in its measurability. You can track the performance of your campaigns in real-time, allowing you to identify what’s working and what’s not. This data-driven approach allows you to continuously optimize your strategies and maximize your return on investment (ROI).

- Increased Credibility: A well-crafted digital presence builds trust and credibility with potential sellers. By showcasing your expertise, experience, and positive client testimonials, you position yourself as a reliable and trustworthy buyer, making sellers more likely to reach out to you with their investment opportunities.

- 24/7 Availability: The digital world never sleeps. Having a strong online presence ensures that motivated sellers can find you and learn about your investment focus any time, day or night.

Building Your Digital Marketing Arsenal: Key Strategies for Success

Now that we understand the power of digital marketing for real estate investors, let’s explore the core strategies you can implement to attract motivated sellers and build a thriving investment portfolio:

1. Content Marketing: Establish Yourself as a Market Authority

In today’s information-driven world, content is king. By creating valuable and informative content, you establish yourself as a trusted resource for potential sellers and demonstrate your expertise in the real estate market. Here are some content marketing ideas to consider:

- Blog: Create a blog focused on real estate investing. Share your insights on market trends, investment strategies, and tips for selling a property quickly. Regularly publish informative articles that address common concerns sellers face.

- Market Reports & Guides: Develop downloadable reports and guides on local market conditions, the home-selling process, or the advantages of working with a real estate investor. Offer these resources in exchange for potential sellers’ contact information, building your email list for future marketing efforts.

- Video Content: Consider creating engaging video content that showcases your expertise and investment approach. Highlight success stories of past deals or offer video testimonials from satisfied sellers. Videos can be uploaded to YouTube, shared on social media platforms, and embedded on your website.

2. Website Optimization: Your Digital Headquarters

Your website is your online storefront, and it’s crucial to optimize it for both user experience and search engines. Here’s what you need to consider:

- Mobile-Friendly Design: A significant portion of web traffic comes from mobile devices. Ensure your website is mobile-friendly and offers a seamless user experience for all visitors.

- Clear Value Proposition: Clearly communicate who you are, what type of properties you invest in, and the benefits you offer to sellers.

- Call to Action (CTA): Make it easy for potential sellers to reach out to you. Include clear CTAs throughout your website, such as contact forms, phone numbers, and email addresses.

- Local SEO Optimization: Optimize your website for local search results. Include relevant local keywords throughout your content, meta descriptions, and page titles. Claim and optimize your Google My Business listing to increase your visibility in local searches.

3. Social Media Marketing: Engaging with Potential Sellers

Social media platforms offer a powerful tool to connect with potential sellers and build brand awareness. Here’s how to leverage social media effectively:

- Identify Your Target Platforms: Focus your efforts on social media platforms frequented by your target audience. For real estate investors, this might include LinkedIn, Facebook, or local community groups.

- Create Engaging Content: Share content that is informative and valuable to potential sellers. This could include local market updates, tips for preparing a house for sale, or success stories of past deals you’ve closed.

- Run Targeted Ads: Many social media platforms offer sophisticated ad targeting options. Leverage these tools to reach a highly targeted audience of motivated sellers based on demographics, location, and interests.

4. Email Marketing: Building Relationships and Nurturing Leads

Email marketing is a powerful tool for nurturing leads and building long-term relationships with potential sellers. Here are some key strategies:

- Build Your Email List: Grow your email list by offering valuable incentives like downloadable content, market reports, or early access to exclusive deals. Encourage website visitors and social media followers to subscribe.

- Segment Your Audience: Segment your email list based on interests and property types. This allows you to send targeted emails that are more relevant and engaging to each recipient.

- Nurture Leads with Valuable Content: Don’t bombard your audience with constant sales pitches. Provide valuable content that educates and informs potential sellers throughout the sales cycle. Offer tips on preparing a house for sale, navigating the closing process, or the benefits of working with a real estate investor.

- Maintain Consistent Communication: Stay top-of-mind with potential sellers by sending out regular email newsletters. However, avoid coming across as spammy. Aim for a balance between providing valuable information and promoting your services.

5. Partnering with Real Estate Professionals

Building relationships with real estate agents, property managers, and other professionals in the industry can be a valuable source of leads. Consider offering referral fees to incentivize them to connect you with motivated sellers who might be a good fit for your investment strategy.

6. Paid Advertising: Expanding Your Reach

While organic marketing strategies are essential, consider supplementing your efforts with paid advertising platforms like Google Ads or social media advertising. This allows you to target a wider audience and reach highly motivated sellers actively searching for ways to sell their property quickly.

7. Track and Measure Your Results

The beauty of digital marketing lies in its measurability. Use website analytics tools to track key metrics like website traffic, lead generation, and conversion rates. Regularly analyze your data to identify what’s working and what’s not. This allows you to optimize your strategies, refine your target audience, and maximize your return on investment (ROI).

Conclusion: Mastering the Digital Landscape for Real Estate Success

By implementing these digital marketing strategies, you can establish a strong online presence, attract a steady stream of motivated sellers, and fuel your real estate investing success. Remember, consistency is key. Continuously create valuable content, engage with your audience, and refine your approach based on data insights. The digital landscape presents a powerful opportunity for real estate investors to thrive in today’s market. Embrace the power of digital marketing and watch your portfolio flourish.

Ready to Unleash the Power of Digital Marketing for Your Real Estate Investing?

Dominating the digital landscape can feel overwhelming, but you don’t have to go it alone. WEB801 is your one-stop shop for all your real estate investor digital marketing needs.

Our team of experts can help you:

- Develop a comprehensive digital marketing strategy: We’ll work with you to understand your investment goals and target audience, crafting a customized plan to attract motivated sellers.

- Craft high-quality content: Our content marketing specialists will create informative and engaging content that establishes you as a market authority and positions you as the go-to buyer for potential sellers.

- Optimize your website for lead generation: We’ll ensure your website is mobile-friendly, user-friendly, and optimized for local search, converting website visitors into qualified leads.

- Execute targeted social media campaigns: Expand your reach and connect with motivated sellers on the platforms they frequent most.

- Develop a data-driven email marketing strategy: We’ll help you build your email list, segment your audience,and nurture leads with valuable content that drives conversions.

- Track and analyze your results: Our team will provide ongoing data insights to measure the effectiveness of your campaigns, allowing you to continuously optimize your approach and maximize your ROI.

Develop a content strategy

Identify your target audience and the specific topics that will be most relevant and interesting to them. Consider what sets your company apart from others in the industry and focus on highlighting those unique aspects.

- Identifying your target audience is crucial to creating effective content.

- Consider factors such as age, income, location, and interests when identifying your target audience. Once you know who you’re writing for, you can tailor your content to meet their specific needs and interests.

- Specific topics that will be most relevant and interesting to your target audience should be identified. This could be anything from investment strategies and market trends to local events and neighborhood profiles.

- Consider what sets your company apart from others in the industry and focus on highlighting those unique aspects. This could be your team’s expertise, specialized services, or a particular niche you focus on. By showcasing your unique selling points, you’ll be more likely to attract and retain customers.

The TOP 50 Real Estate Investment Topics to Blog About (in 2024)

1. The benefits of investing in real estate.

The benefits of investing in real estate can include a steady stream of passive income, appreciation in property value, and potential tax benefits.

Passive income can be generated through renting out the property, and appreciation in property value can occur due to market conditions, or by making improvements to the property.

Tax benefits can include deductions for mortgage interest, depreciation, and operating expenses.

2. How to find and evaluate potential investment properties.

To find and evaluate potential investment properties, investors can use a variety of tools and strategies such as market analysis, property inspections, and financial analysis to determine the potential return on investment.

By analyzing market trends and conditions, investors can identify areas where properties are likely to appreciate in value.

Property inspections can be used to identify any repairs or renovations that may be needed, and financial analysis can help determine the potential rental income and cash flow.

3. The different types of real estate investment strategies.

Different types of real estate investment strategies include fix and flip, buy and hold, and wholesaling.

Fix and flip involves buying a property in need of repairs, making those repairs, and then reselling the property for a profit.

Buy and hold involves purchasing a property and then leasing it out to tenants for a consistent stream of passive income.

Wholesaling involves finding properties at a discounted price and then reselling them to another investor.

4. How to finance a real estate investment.

Financing options for real estate investments include traditional mortgages, hard money loans, and private money loans.

Traditional mortgages are typically obtained from a bank or other financial institution, while hard money loans and private money loans are usually obtained from private investors.

5.The process of rehabbing and flipping a property.

Rehabbing and flipping a property involves buying a property that is in need of repairs, making those repairs, and then reselling the property for a profit.

This type of investment can be a good way to make a quick return on investment if done correctly.

Investors will need to have a good understanding of the real estate market, the cost of repairs, and what the property will be worth once the repairs are made.

This strategy can be risky if the costs of repairs are underestimated or if the market conditions change after the purchase.

6. The process of buying and holding a rental property.

Buying and holding a rental property involves purchasing a property and then leasing it out to tenants for a consistent stream of passive income.

This can be a good way to generate a steady cash flow and build long-term wealth through property appreciation.

To be successful, landlords will need to understand the rental market, be able to find and screen tenants, and be able to manage and maintain the property effectively.

7. How to find and screen tenants for a rental property.

To find and screen tenants for a rental property, landlords can use various tools and methods to find and screen tenants.

These include background checks, credit checks, and interviews.

This can help the landlord determine a tenant’s suitability and the likelihood that they will be able to pay the rent on time and take care of the property.

8. How to properly manage and maintain a rental property.

Properly managing and maintaining a rental property includes tasks such as collecting rent, handling repairs and maintenance, and enforcing lease agreements.

It also includes keeping up with the laws and regulations related to being a landlord.

Proper management and maintenance can help ensure that the property remains in good condition, that tenants are happy, and that the landlord is able to generate consistent income.

9. The tax benefits of real estate investing.

Real estate investments can provide tax benefits such as deductions for mortgage interest, depreciation, and operating expenses.

These tax benefits can help investors save money and increase the return on their investment.

However, it is important to note that tax laws and regulations can change, and investors should consult with a tax professional to understand how these benefits may apply to their specific situation.

10. How to exit a real estate investment.

Exiting a real estate investment can involve selling the property, refinancing, or renting the property.

Selling the property can provide a lump sum of cash, but it also means that the investor will no longer have ownership of the property.

Refinancing can provide cash and allow the investor to continue owning the property.

Renting the property can provide a steady stream of passive income, but it also means that the investor will continue to be responsible for the property and will have to manage it as a landlord.

Other Topics Worth Considering for a Real Estate Investor Blog

11. How to use leverage in real estate investing.

12. How to build and maintain a real estate investment portfolio.

13. How to find and work with a real estate agent.

14. How to analyze cash flow and return on investment.

15. How to use market analysis to identify profitable investments.

16. How to find and use real estate investment tools and software.

17. How to create a business plan for a real estate investment company.

18. How to network and build a team of real estate professionals.

19. The impact of interest rates on real estate investing.

20. The impact of the economy on real estate investing.

21. How to spot and avoid common real estate investing mistakes.

22. How to use technology to improve real estate investing.

23. How to use crowdfunding to finance a real estate investment.

24. How to use self-directed IRA to invest in real estate.

25. How to invest in real estate with little or no money down.

26. How to invest in real estate with a small budget.

27. How to invest in real estate as a beginner.

28. How to invest in commercial real estate.

29. How to invest in real estate development.

30. How to invest in real estate through REITs.

31. How to invest in real estate through partnerships.

32. How to invest in real estate using options.

33. How to invest in real estate using lease options.

34. How to invest in real estate using owner financing.

35. How to invest in real estate using virtual assistant.

36. How to invest in real estate using online marketplaces.

37. How to invest in real estate using online platforms.

38. How to invest in real estate using online tools.

39. How to invest in real estate using online resources.

40. How to invest in real estate using online education.

41. How to invest in real estate using online communities.

42. How to invest in real estate using online networks.

43. How to invest in real estate using online software.

44. How to invest in real estate using online systems.

45. How to invest in real estate using online calculators.

46. How to invest in real estate using online databases.

47. How to invest in real estate using online maps.

48. How to invest in real estate using online analytics.

49. How to invest in real estate using online market data.

50. How to invest in real estate using online market trends.

Please note: this list isn’t exhaustive.

The specific topics for blog posts can vary depending on the focus and goals of your real estate investment business.

Research and gather information

Conduct thorough research on the real estate market, industry trends, and any relevant news or events. Gather data and statistics to support your content and make it more credible.

- Conducting thorough research on the real estate market, industry trends, and any relevant news or events is crucial to creating credible and informative content. This will help you stay up-to-date and provide valuable insights to your readers.

- Gather data and statistics to support your content and make it more credible. This could include information such as median home prices, rental rates, and property appreciation rates in the areas you focus on.

Create a variety of content

Mix it up with blog posts, infographics, videos, and other types of content to keep things interesting for your readers.

- Mixing it up with different types of content such as blog posts, infographics, videos, and other formats will keep things interesting for your readers. This can help to attract a wider audience and increase engagement.

Use storytelling

Use storytelling to make your content more engaging and memorable. Share success stories of your past investments, or talk about the process of acquiring a new property.

- Storytelling is a powerful tool that can help make your content more engaging and memorable. Share success stories of your past investments, or talk about the process of acquiring a new property. This can help to humanize your brand and build trust with your audience.

Optimize for SEO

Use keywords and meta tags to make your content more search engine friendly. This will help increase visibility and drive more traffic to your website.

- Using keywords and meta tags to make your content more search engine friendly will help increase visibility and drive more traffic to your website. This could include including relevant keywords in your headlines, meta descriptions, and body content.

Promote your content

Share your content on social media, email marketing campaigns, and other channels to increase visibility and attract new readers.

- Share your content on social media, email marketing campaigns, and other channels to increase visibility and attract new readers.

- This could include creating social media posts to promote your blog, or including a link to your latest blog post in your email newsletter.

Evaluate and improve

Use analytics to track the performance of your content and use this information to improve and refine your strategy over time.

- Use analytics to track the performance of your content and use this information to improve and refine your strategy over time.

- This could include tracking metrics such as website traffic, social media engagement, and conversion rates.

- This can help you to identify what works well and what doesn’t, so you can make adjustments to your strategy as needed.

Stop letting motivated sellers slip through the cracks. Contact WEB801 today for a free consultation and unlock the full potential of digital marketing for your real estate investing success!

UPDATED: February 7th, 2023

I talk with clients all the time about ROI – Return on Investment.

One of my main objectives when building a new website & digital marketing strategy is helping the client SEE the ROI as quickly as possible.

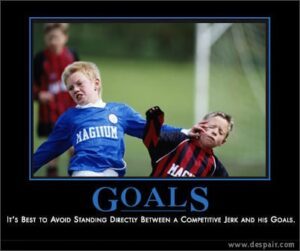

Naturally goals come into the conversation.

To help a client set realistic goals, I ask questions:

Where are you now?

Where do you want to be in a year from now?

What’s your website doing for your business to help you get there?

If we do ___________, how will that affect ______________?

What does success look like for your business website?

These are all important questions we review early on in the Discovery Process.

When I think about goals, the Serenity Prayer comes to mind:

God, grant me the serenity to accept the things I cannot change,

Courage to change the things I can,

And the wisdom to know the difference.

I can’t always control everything.

Sometimes, no matter how much work I do on a project, the results aren’t coming as quickly as I’d like.

I have to make adjustments.

Making Goal Adjustments

I love sports.

I played a lot of sports as a kid. And I learned many valuable lessons that have helped me as a business owner today.

One of those lessons is that I can’t control my height.

Growing up I played basketball nearly every day. But no matter how much I practiced, that practice wasn’t going to change my height (something I couldn’t change).

Eventually I had to change my goals and focus on other priorities.

That experience, along with countless others in business, brings me to the point of today’s conversation: Performance Goals vs. Outcome Goals.

Performance vs Outcome Goals – What’s the Difference?

Have you ever heard of these concepts?

Performance Goals?

Outcome Goals?

Why are these types of goals even worth considering?

We all want outcomes, results, money in the bank.

We all want outcomes, results, money in the bank.

But before that happens we have to take the necessary steps to get everything in place.

As I’ve studied about goals and goal setting, a couple terms kept coming up: performance goals & outcome goals.

The summary of the two goals is simple:

I CAN control a performance goal.

I CAN’T control an outcome goal.

In other words,

“Performance based goals can be controlled by the person who sets the goals while outcome based goals are frequently controlled by others…Performance goals focus on the person’s performance while outcome goals focus strictly on the outcome or result.”

This is really helpful when thinking about goals for a business.

What CAN I control?

What CAN’T I control?

Help me to know the difference!

The Danger of Outcome Goals

Goals based on outcomes are extremely vulnerable to failure because of things beyond my control.

For example, I might achieve a personal best time in a race, but still be disqualified due to a mistake by the judge.

If my outcome goal was to be in the top three, then I’m screwed.

However, if I set a performance goal of achieving a particular time, then despite the outcome or the decisions of others, I’ll have achieved the goal and can know I did my best.

Another example of an outcome goal is to make a certain amount of money.

In my Moller Mission Statement, I set some specific “outcome goals”.

But, in front of those outcome goals were well defined, written out action steps (or “performance goals”) that I committed to in order to give myself the best chance to achieve the final result.

If I want to make a certain amount of money, I’d better set specific goals I have control of that lead me down that path.

So here’s an important question:

What performance goals can I set that will help me achieve the outcomes I’d like to see?

The Power of Performance Goals

I have control of performance goals. They are measurable, things I can track.

In an online business, performance goals may be things like this:

- I will write one article per week on Wednesday.

- I will contact 2 businesses today in my target niche.

- I will reach out to 2 podcasts today to offer to guest speak.

- I will create 3 videos on Friday of this week & schedule them to publish.

- I will record my performance on a spreadsheet.

- I will report back to my mentor.

Do I have “outcomes” in mind?

YES!

But the outcomes are based more on my performance than anyone else’s.

It doesn’t say I will close 2 deals this week. But by contacting 2 businesses this week, I’m giving myself the best chance to make connections that will result in new business.

Here are some questions to consider when setting “performance goals” for your online business:

- What do I need to do today to make a sale?

- How many people do I plan to contact every day to build my network?

- When I contact these people, what am I going to ask them?

- What content am I going to consume to get ideas for help with my sales?

- How many current clients will I talk to about their purchases and attempt to get repeat business with?

- Do I have a “Plan of Attack” on what I’m going to do each day to increase the chances of making more sales?

How Do I Apply This Information Today?

Here’s a real example that I’m working on in order to implement the performance goal ideas:

I have a goal, maybe it’s an outcome goal, to use video more as a marketing channel in my business.

Ultimately I want to create online courses that help my clients grow their online businesses.

Video is an essential piece in that puzzle.

So I need to get going with video creation.

Where am I now?

I have two YouTube Channels.

One has 1,150 subscribers, 1,164,471 views, and was started on May 19th, 2013.

The other has 20 subscribers, 30,989 views, and was started on March 16, 2012.

The first one has all kinds of random videos: a funny dance recital video that has over 1 MILLION views, family stuff, DIY handyman stuff, a pool install, and some website tips and tricks. Not very focused or niche.

The second one has mostly just website tips, tutorials, & guidance. But obviously very little traction.

The first is currently titled VID801.

The second is currently titled Nate Moller.

My natural inclination is to continue to grow the VID801 channel. But in all my video research, there’s a lot of clean up that would have to happen.

And the majority of those subscribers are probably mostly interested in the funny dance recital – NOT digital marketing.

So, my decision is to work on the Nate Moller channel.

Here are my performance goals:

1. I will have my designer create a channel style guide (banner background, icon, color scheme, logo implementation, etc.)

2. I will review content I currently have and create an editorial calendar, focusing on creating 3 videos every Friday.

3. I will watch 2 of the the 400+ Watch Later videos every day and take detailed notes on what I’m learning.

4. I will IMPLEMENT those notes in my video strategy.

5. I will record my progress in a Google Spreadsheet.

So that’s my plan.

Sharing it with readers like you can be helpful.

Now that I’ve written it out, printed it, and put it on my desk, I plan to remind myself of it each day.

Let’s get your take on this.

What are “Performance Goals” you plan to set the help you get the “Outcomes” you want?

Leave a comment below! 👇